How to Find Pre-Foreclosure Leads

Let’s be honest: good real estate leads are getting harder to find.

Cold calling FSBOs, chasing down expireds, and praying your social ads hit — these methods aren’t enough anymore. To win in this market, you need to be more strategic.

Enter pre-foreclosure leads.

These homeowners are in financial distress, motivated, and often overlooked by the average agent — which is precisely why top producers go after them.

This guide will walk you through:

- What pre-foreclosure leads are (and why they matter)

- How to find them the old-school way (and why that’s broken);

- The smarter, faster way to generate listings using Vulcan7;

- How to connect with homeowners without sounding like a vulture.

Let’s dig in.

What Are Pre-Foreclosure Leads?

Pre-foreclosure is the stage where a homeowner has missed mortgage payments, and the bank has started the foreclosure process — but hasn’t yet taken the home. It’s a limited window, and for agents, it’s a golden one.

Why?

- The homeowner still owns the property and can sell to avoid foreclosure;

- They’re often motivated to act quickly;

- These homes are not listed yet — meaning you’re competing with fewer agents;

- You can uncover equity-rich properties and offer solutions.

In short, you’re solving a problem, not selling a pitch. That’s why pre-foreclosure leads are one of the best ways to consistently uncover listings in any market.

How to Find Pre-Foreclosure Leads: The Traditional Way

If you’ve ever gone down the rabbit hole of trying to find pre-foreclosure leads the “old-fashioned” way, you know how painful it can be. If you don’t, well, let’s just say that it’s a deep and curvy hole to dive into.

Let’s look at what that typically involves:

Digging Through Public Records

Yes, you can go to your county clerk’s office (or website) and search for Notices of Default (NODs), Lis Pendens, or foreclosure filings. It’s free, and the data is official. But here’s the reality: it’s a grind.

You might spend hours filtering PDFs or scanning confusing legal documents — only to walk away with five leads that don’t even have contact info.

Sending Direct Mail

Once you’ve gathered your list, you can fire off postcards or letters. The idea is to let homeowners know they have options before the bank takes over.

The problem? Without consistent effort and good data, response rates are low, and ROI is questionable.

A lot of agents send one postcard and wonder why no one called.

You need multi-step campaigns, strong messaging, and follow-up sequences for mail to really work.

Driving for Dollars

This old-school tactic involves driving through neighborhoods looking for neglected properties — tall grass, piled-up mail, boarded windows, you know the type. Then, you research ownership and reach out.

This is actually a good strategy for geo farming. Unfortunately, it is inefficient, doesn’t scale, and can lead to many dead ends, especially in the long run.

Yes, you might stumble onto a gem, but it’s like panning for gold — eventually, your time is better spent elsewhere.

Networking with Attorneys or Lenders

Some agents build relationships with bankruptcy attorneys, probate lawyers, or mortgage reps who can give them a heads-up when a client is facing foreclosure.

It’s not a bad tactic, plus it helps you build rapport with local business owners. On the other hand, it takes a lot of time to build trust. There’s also no guarantee that your sources will provide consistent lead volume.

Vulcan7: The Smarter Way to Find Pre-Foreclosure Leads

Most of the traditional approaches to prospecting pre-foreclosure leads involve manual work, fragmented tools, and slow timelines. Luckily, there’s an alternative.

If you want speed, accuracy, and leads that actually convert — you need a system. That’s exactly what Vulcan7 gives you.

We’re not just a lead provider. We offer a fully integrated pre-foreclosure prospecting platform that helps agents reach distressed homeowners quickly without chasing paperwork or cold leads.

Let’s walk through how it works.

#1 Get Clean, Ready-to-Work Pre-Foreclosure Leads

Forget scouring court records or patching together lists from outdated spreadsheets. With Vulcan7, you get:

- Pre-foreclosure leads updated in real-time;

- Verified owner contact info (emails, phone numbers, addresses);

- Clean lists you can immediately take action on.

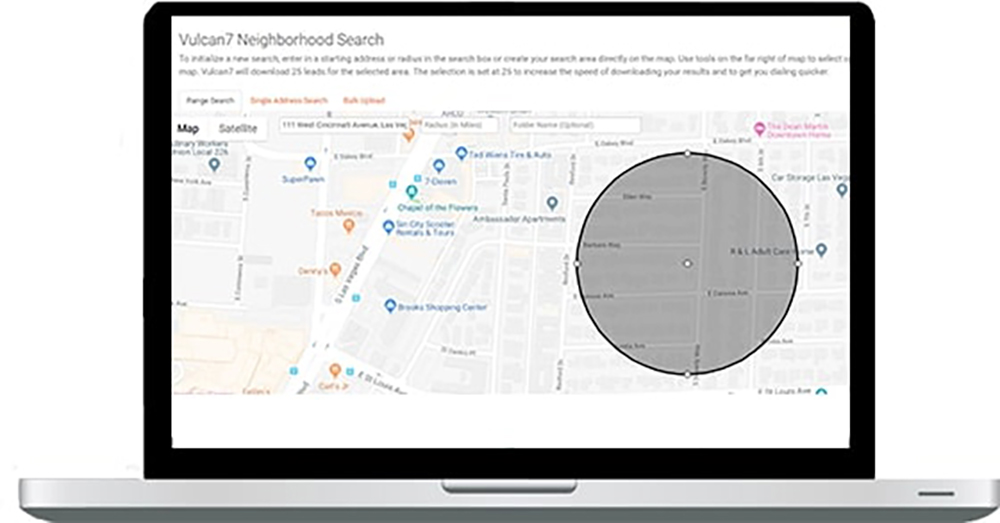

#2 Zero In with Neighborhood Search

Use Vulcan7’s Neighborhood Search to target the exact areas and property types you want while building your geo farm.

Filter by:

- ZIP code or radius from a subject property;

- Ownership duration (e.g. over 5 years);

- Equity position (e.g. 30%+);

- Owner-occupied vs. absentee.

#3 Dial Smarter with the Built-In Dialer + CRM

The real power move? Combining your lead list with Vulcan7’s integrated power dialer and CRM. No exporting, no switching between tools, no excuses.

- Call hundreds of leads in hours, not days;

- Auto-log conversations and notes;

- Schedule automatic follow-ups;

- Organize leads by status (e.g., “Contacted,” “Not Ready,” “Booked Appointment”).

#4 Actually Reach Distressed Homeowners with Accurate Data

What’s the point of a list if the phone numbers don’t work?

Vulcan7’s pre-foreclosure data is verified and scrubbed for accuracy, giving you:

- Up to 3 phone numbers per contact;

- Multiple emails (when available);

- Accurate physical and mailing addresses.

How to Convert Pre-Foreclosure Leads

This is where the rubber meets the road. Pre-foreclosure listings aren’t like expireds or FSBOs — you’re dealing with homeowners in real distress, and your approach needs to reflect that.

Let’s break down what actually works in the field.

Lead with Empathy

When you call a pre-foreclosure lead, you’re not just introducing yourself — you’re walking into their personal storm. Instead of diving into a pitch, lead with curiosity and concern.

Ask open, low-pressure questions like:

- “Are you still planning to stay in the home long-term?”

- “Would it help if I shared a few options that have worked for other homeowners in a similar situation?”

- “Are you currently working with anyone on a plan to keep or sell the property?”

❌ What to avoid:

- “I noticed your home’s in pre-foreclosure.” It’s too direct and triggers shame or fear.

- “I specialize in distressed properties.” Sounds opportunistic.

Offer Options, Not Ultimatums

People don’t want to be told what to do. They want to feel like they’re in control of their own decision. Your job is to educate, not push.

Be the agent who brings solutions to the table, such as:

- Selling before the auction to protect equity;

- Short sales (if underwater on the loan);

- Leaseback arrangements (where they sell the home but stay temporarily);

- Loan modification or credit repair referrals to keep the home.

Follow Up Respectfully & Consistently

You’re not going to win their trust with one phone call, and that’s OK. Most conversions happen after multiple touches (often between 5–7). The key is to stay visible without being annoying.

Use a multi-channel follow-up plan:

- Day 1: Initial call with a voicemail;

- Day 3: Send a text that’s friendly and low-pressure (“Hi [Name], just checking in—no rush on anything, but I’m happy to share some resources if helpful.”);

- Day 6: Follow-up email with the Homeowner Options PDF;

- Day 10: Drop a handwritten note or flyer by the house;

- Day 14+: Set a reminder in Vulcan7 to follow up via call or email.

Speak Like a Human, Not a Script

Scripts are helpful for keeping you on track, but if your conversation sounds robotic or rehearsed, the homeowner will check out.

You’re not a telemarketer. You’re a professional advisor.

Here’s the difference:

🚫 Script-y: “Hi, this is John Smith with XYZ Realty. I saw your property was in pre-foreclosure and wanted to offer my services…”

🧑💼 Human: “Hey [Name], my name’s John, I’m a local real estate agent. I’m reaching out because I work with a lot of homeowners in similar situations. No pressure at all — but if you’d like to hear some of the ways I’ve helped others, I’m happy to share.”

Mistakes to Avoid

Okay. You know what to do. Now let’s cover what you should never do when prospecting pre-foreclosure listings:

❌ Don’t Mention “Foreclosure” Too Early

The F-word — foreclosure — can be loaded. It can trigger shame, anger, or fear. Avoid saying it until they open the door to that part of the conversation.

Instead, talk about “homeowner challenges,” “ownership changes,” or “exploring options.”

❌ Don’t Push Them to List Right Away

You may see the obvious solution, but they’re still in the emotional trenches. Pushing too hard to list the home makes you seem to care more about your commission than their situation.

Take a consultative approach: “Listing is definitely one option, but only if it feels right to you. I’m happy to walk through all the paths you can take, no pressure either way.”

❌ Don’t Ghost After One Call

This is where most agents fail.

They make one call, get no answer, and move on. Meanwhile, the seller talks to someone else three weeks later — and that agent gets the listing.

Consistency builds trust. Don’t disappear. Use Vulcan7’s follow-up automation to remind yourself to check back in with leads at regular intervals.

❌ Don’t Treat Them Like a Number

You’re not cold calling a business owner. You’re reaching out to someone whose life may be unraveling a bit. If you treat them like just another lead, they’ll feel it.

And they’ll shut down.

Use their name. Ask how they’re doing. Reference previous calls. Be the person who showed up when it mattered.

Put It All Together: Your 5-Step Pre-Foreclosure Prospecting Plan with Vulcan7

Now that you’ve got the tools, the tone, and the tactics — here’s how you execute day-to-day (with a little help from our very own Vulcan7):

✅ Step 1: Pull Fresh Leads Weekly

Log into Vulcan7 every Monday morning. Filter by equity, ZIP code, and ownership status. Prioritize homeowners with higher equity and recent default notices.

✅ Step 2: Narrow Focus with Neighborhood Search

Use filters to find the highest-quality leads in the areas you know best. Save those search settings and revisit them regularly.

✅ Step 3: Call with the Power Dialer

Schedule 1–2 calling blocks daily. Use Vulcan7’s dialer to work through leads efficiently, leave voicemails, and track who you connect with.

✅ Step 4: Follow Up with Intention

No spray-and-pray. Every touch should feel personalized. Rotate between calls, texts, emails, and even physical mailers or door-knocking if appropriate.

✅ Step 5: Offer Real Help, Not Pressure

Be the local advisor, not the closer. Provide options. Share resources. Ask good questions. Let trust build naturally — because that’s what leads to signed listings and long-term success.

Be the Agent Who Shows Up When It Matters

Pre-foreclosures aren’t just another lead type. They’re a real opportunity to help homeowners make smart decisions during tough times — and to build a thriving business doing it.

But converting pre-foreclosure leads isn’t about having the best pitch. It’s about showing up with the right mindset.

These homeowners don’t want to be “sold” — they want to be understood.

When you lead with value, stay consistent, and use smart tools like Vulcan7 to systematize your approach, you position yourself as a trusted expert — and the go-to agent when they’re ready to make a move.

RECOMMENED ARTICLES

Real Estate Prospecting Automation Tips for 2025: Automate & Close More Sales

Any real estate agent knows the hustle of juggling cold…

Read MoreHow to Master Circle Prospecting: Best Tips & Strategies for Agents

How to Master Circle Prospecting: The Real Estate Agent’s Complete…

Read MoreHow to Maximize Your Real Estate Lead Generation: Best Tips & Strategies for Agents

We all know lead generation is the lifeblood of success…

Read More